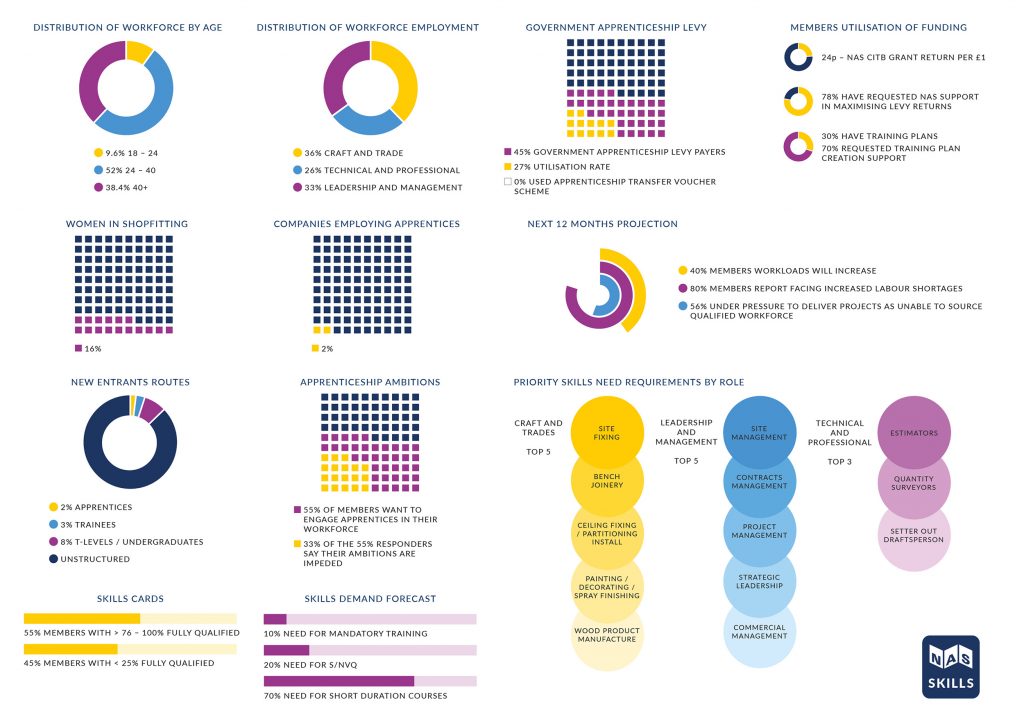

Last month we took at deep dive into the findings of the skills demand produced by the sector wide training needs analysis (TNA22) which covered: the distribution of age, workforce employment roles, NAS Apprenticeship growth rate and the utilisation of the Government Apprenticeship Levy. You can revisit part one below.

What further sector intelligence does the TNA findings tell us as a specialist sector?

There is no role that excludes in our sector – NAS Gender Demographics

If you are looking to attract the new generation into your company, we would be foolish not to consider the variations of social and cultural values across the generational zones, and how this translates into our differing NAS member companies.

You will often hear these three words – equality, diversity and inclusivity in construction clustered together, while some NAS member companies will have increased capacity and personnel to focus and drive this message home to attract new talent, the alternative perception is that smaller companies do not.

The findings and member engagement tell us a different story. Based on gender alone, there is no role that excludes women in our sector. In fact, the measure of gender demographics tells us that our sector is ahead of the curve statistically.

The construction industry average and data reports that women in construction is now 13%, while our sector is ahead at 16%. A 3% differential is not just a slight marginal gain. We know that across the craft, technical and leadership fields, women are a part of the success of our sector. When we speak with members, we know there are females on the tools, in the design, planning and surveying fields and in directorial roles, with many female managing directors established and leading successful NAS member companies. If we were to call a spade a spade, that archaic view that the women in shopfitting are operating in the back office, is simply that, archaic. The NAS as a trade association spans two millennia, we have come a long way since 1919.

In the operations and business development roles crucial to the success of any member company, the driving talent across business development, specifications, key account management and administration roles, is home to all genders. That 16% figure, tells us that, yes there is more to do, more gains to make, but the increasing void that is the skills crisis means to exclude and not attempt to create attraction growth for up to 50% of the UK population is unwise. We tell school children its more than okay to work with your hands, and we push home the key message that within the NAS, its not just for boys. In this sector the intelligence shows – we think differently, against the backdrop of the wider industry.

The Utilisation of Funding for NAS Member CITB Levy Payers

Here at the NAS, we recognise that members perceptions and experiences of the CITB services and products differ between the positive and the negative for several reasons. It is our job as a consensus federation to represent you and hold the guardians of the levy to account – as to where the NAS membership levy is spent, and to maximise that levy return on grant funded training and sector specific development progression.

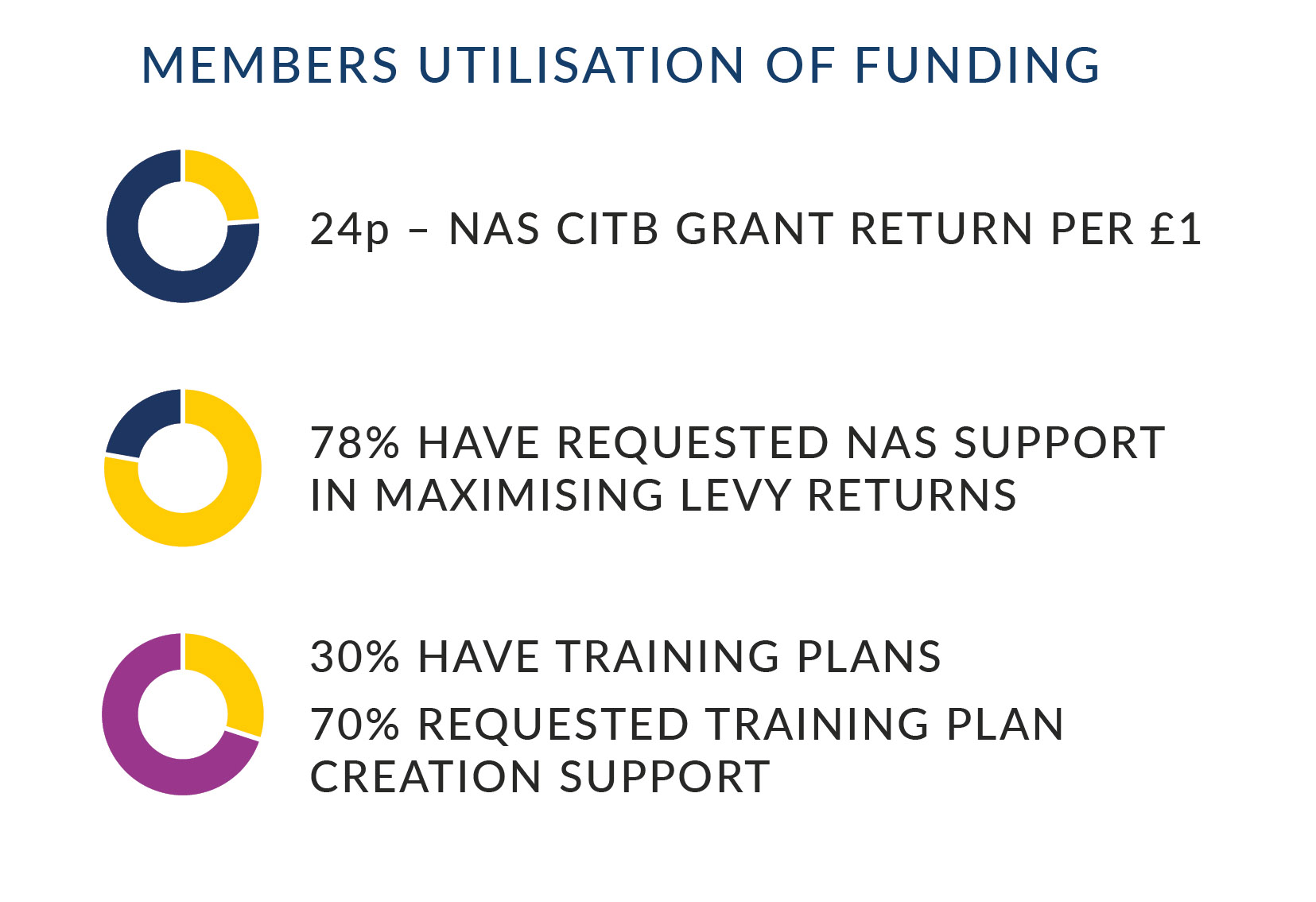

Unfortunately, that is where the TNA sector intel paints a stark picture. Our figures mirror our findings found from the evidence unearthed in our Freedom of Information requests. Although levy payments were paused and reduced during the covid 19 first response, the figures tell us that for every £1 collected from the NAS membership, only 24p is awarded back in CITB grant format.

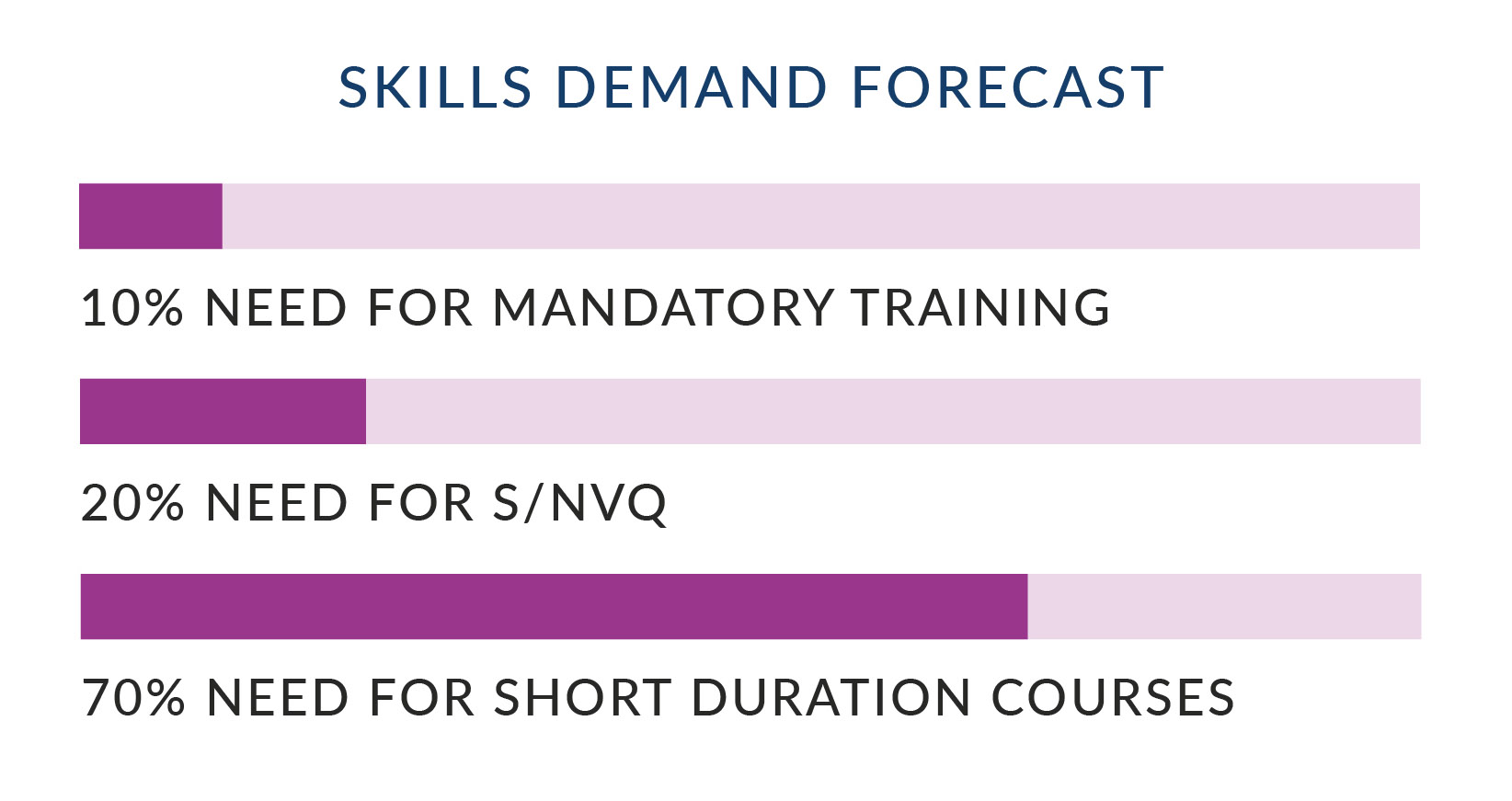

We know the 24p claim back comes mostly from our tier one and larger SME’s which leaves a window of approximately 70% of the NAS membership unable to use grant awards feasibly beyond contractually mandatory training, such as IPAF, PASMA, and SMSTS etc. This is not sector specific training, its generic across the wider construction industry. The TNA show mandatory training makes up only 10% of need in the skills demand forecasts.

Back to the 24p situation, there are multiple reasons for this, whether specialist training has not been formalised or developed, or there is no assessment or training provision to support this. Our members need to know where the remaining 76p goes and we question how that remainder can be use against our priority skills needs, routeways in to the shopfitting arena and qualification and competency development. The use of the results and baselines create the collateral we needed to formulate a new NAS Skills Strategy, (launching this quarter) to tackle our skills needs as forecasted by the membership to build key strategic activities, to turn around this lack of provision and maximise all CITB grant awards for levy payers.

As the illustration indicates, 78% of members are requesting assistance in maximising levy grant returns with a further 70% seeking support to create training plans. We have been listening and in 2023 we will build in functionality with new NAS partners to tackle this independently for you, as part of membership services and benefits. Providing an alternative to existing CITB advisory functions and to get you skills and levy fit via our 2023 NAS Skills Clinics.

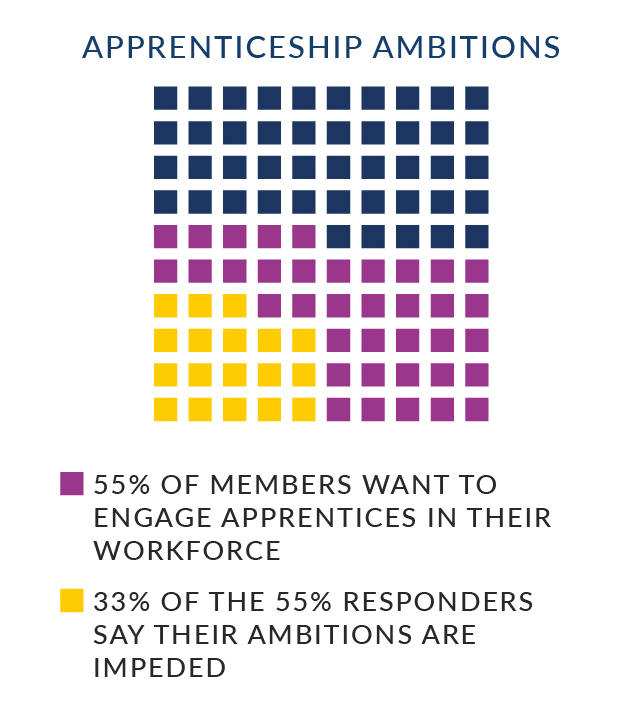

For every member impeded in recruiting an apprentice, that is another part of levy payments taken for purpose, but not returned. Access to apprenticeship annual attendance grant awards and apprenticeship qualification outcome awards cannot be claimed to its maximum. Combined, that award of grants funding is at £3,500k upwards, based on just one member taking on one Level 2 apprentice.

(In part one of this two-part feature we discussed the development of new sector apprenticeships works undertaken by NAS Skills. Our response to tackle this head on.)

Sector-wide Competency

There is of course the imperative need for all NAS Contractor members to demonstrate competency. It is often based on a complicated set of evidence related to individuals and teams, with factors including certifications, field observations, number of times a task has been performed, number of years worked in an area, areas of technical expertise, continuing training, and employee performance.

In plain speak we mean: Skills, Attitude, Knowledge, and Experience.

How do we, as a sector, demonstrate competence?

The NAS works in close partnership with the Construction Skills Certification Scheme (CSCS). We are responsible in designing and managing our sector specific competency scheme that meets with expectations of the Construction Leadership Council’s One Industry Logo Action. SICCS is the recognised scheme for the Shopfitting, Fit-out and Interior Contracting Sector (SICCS).

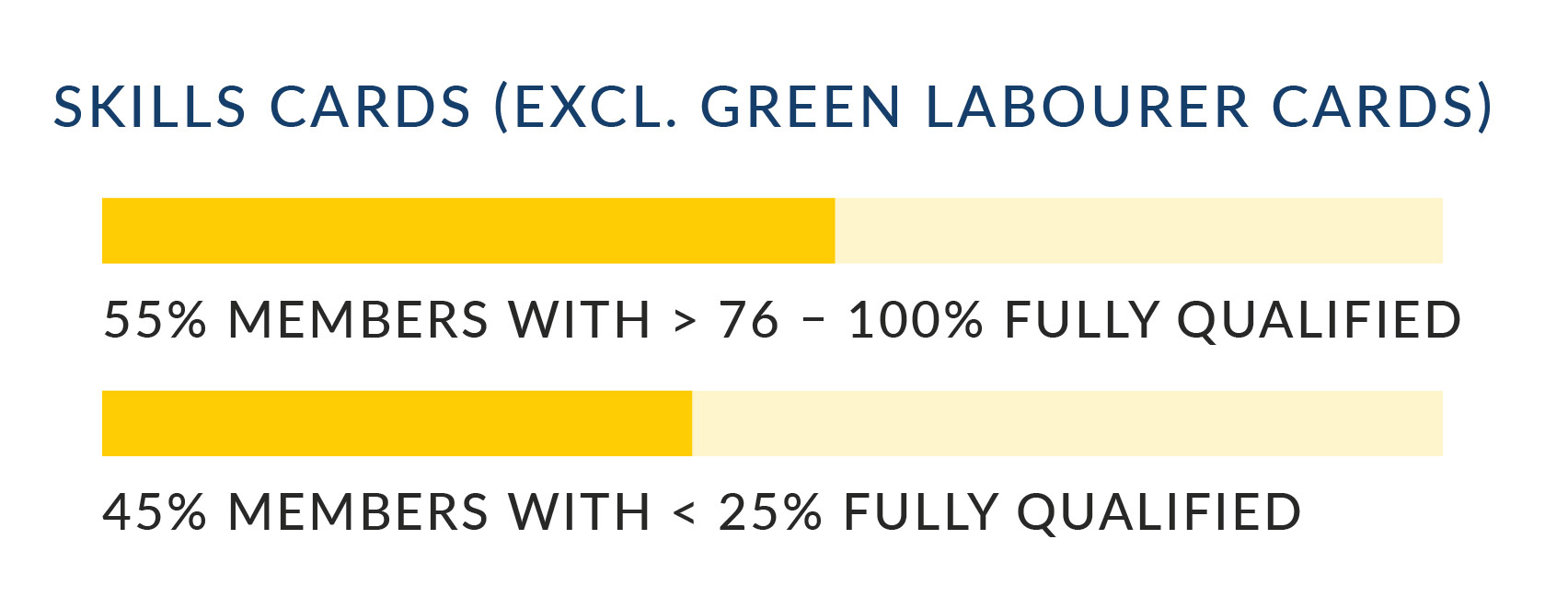

The baseline responses show over all we are working steadily towards achieving a fully qualified workforce, with 55% of members reporting to be at 75-100% fully qualified with skills carded personnel within their workforce. 45% of members report their workforce as being just 25% and under fully qualified rate, so we know that for NAS Skills there is work to be done, and we address this in the soon to be released new NAS Skills Strategy based on the evidence here.

As your contractual scope increase, clients will look to their supply chain’s company competency assurances. This has a knock-on effect and corroborates the finding of the priority skills needs by roles results, and puts some NAS members under increased pressures both on current and future projects impacted by qualified labour shortages.

Future Contractual Obligations and the next 12-month projections

As mentioned, we are discussing the top line header findings, there is plenty more to discuss, but the final area in this piece uncovers the potential risk and threats the sector faces. NAS business owners, contracts managers, commercial managers, supply chain managers and those appointed persons in smaller SME’s report that it is getting tougher out there. We know that work loads are increasing and a staggering 80% of the membership report increased labour shortfalls.

This damages business sustainability and growth. The skills gap was at red alert 20 years before the emergence of the new era we are in, post Brexit, the aftermath of Covid 19, coupled with the new immediate energy crisis we face, its challenging for all our SME’s. The acquisition of future contracts are made more difficult as 56% of NAS member companies report they are also under pressure to deliver as a direct impact of the inability to source a fully qualified workforce.

The NAS is Listening

At the NAS, member engagement is critical. Nothing beats that one-to-one interface, but the TNA allows us to draw together as a sector, what is really happening on the ground and highlights the current state of play, pain points and the skills need, in such a way we can lobby and create change. One of those changes at the NAS is the investment in NAS Skills. NAS Skills will solely focus on tackling those avenues in our sector specific needs. In the next edition, the November Skills Focus as part of the newsletter, we will talk in depth about this investment, the NAS Skills Strategy, and the new NAS Skills Council. It is our response to your needs and will highlight our attack on the shopfitting specialist skills gap.

Thank you to all our contributing members, the next TNA will take place in the spring of 2024.

If you would like to talk with, comment or discuss any of the findings across this two-part feature, it’s easy to reach out. Contact Amanda Scott (amanda.scott@shopfitters.org).